Section 2: Counting DBE Participation

Anchor: #i1000454Counting Overview

Once TxDOT determines that work on a project qualifies as a CUF, it then calculates the amount it can count toward its DBE goal. Only the value of the work performed by the DBE firm counts toward the goal. Depending on the nature of the work, different guidance applies.

The following is guidance for counting participation when a DBE firm is:

- Anchor: #UONFBWFJ

- DBE Subcontractor Anchor: #XOGCWODV

- Manufacturer Anchor: #FVQQXBKK

- Regular Dealer Anchor: #BIHJPKIJ

- Packager, Broker, Manufacturer’s Representative Anchor: #XRSBBLCM

- Trucking Firm Anchor: #WYBAISEF

- Joint Venture

DBE Subcontractor

When a DBE firm is a subcontractor it must perform at least thirty percent (30%) of its contract using its own employees, equipment, materials, and resources. When this condition is met, all DBE work performed counts toward the DBE goal. A DBE subcontractor typically furnishes and installs the work item. One hundred percent (100%) of the prime contractor’s payment to the DBE firm will count toward the contract goal. This includes payment for labor and materials.

When a DBE subcontracts to another DBE firm, the value of the subcontracted work may be counted toward the DBE goal. However, work subcontracted to non-DBE firms does not count toward the goal.

Anchor: #i1000514Manufacturer

A prime contractor purchases materials or supplies from a DBE manufacturer. A DBE manufacturer produces, on its premises, materials or equipment used for a project. A DBE manufacturer can also take product and alter it to meet contract specifications. TxDOT counts one hundred percent (100%) of the value of manufactured materials and equipment toward the DBE goal.

Anchor: #i1000524Regular Dealer

A prime contractor purchases material or supplies from a DBE regular dealer. There are two ways a DBE firm can perform as a regular dealer.

- Anchor: #BOQYFEEE

- A DBE firm may have a store or warehouse out of which it sells or leases products to the public. Anchor: #DTVSSPSM

- For bulk items such as petroleum, steel, cement, gravel, stone, or asphalt, a DBE firm must own and operate distribution equipment for the product it is supplying. Any supplementing of regular dealer’s own distribution equipment shall be by a long-term lease agreement and not on an ad-hoc or contract-by-contract basis. The DBE must lease the equipment itself, as well as run the equipment with its own workforce.

If a DBE firm is acting as a regular dealer, sixty percent (60%) of the value of items sold to the project counts toward the DBE goal. TxDOT determines the amount of credit on a contract-by-contract basis.

For example, a dealer will provide pipes for $100,000. Because the DBE firm regularly sells this product as a part of its business, TxDOT counts $60,000 toward the DBE participation goal, or sixty percent (60%) of the value of the items provided.

Anchor: #i1000554Packager, Broker, Manufacturer’s Representatives

A prime contractor purchases material or supplies from a DBE firm, which is neither a manufacturer nor a regular dealer. TxDOT will count the entire amount of fees or commissions charged for assistance in the procurement of the materials and supplies. Goal credit will be granted if the fees or commissions are reasonable.

Anchor: #i1000564Differences between a Manufacturer, Regular Dealer, and Broker

The following example shows the difference under the requirements of the DBE Program between a manufacturer, a regular dealer, and a broker. The example is the furnishing of crushed aggregate meeting a state DOTs specification for such items as aggregate base course.

- Anchor: #QNBMITKV

- Manufacturer (100%) - A DBE as its principal business and under its name produces on its premises crushed aggregate and meets state standard specifications would be considered a manufacturer and the cost of the crushed aggregate produced can be credited 100% towards meeting the goal. Anchor: #JNPMKFMG

- Regular Dealer (60%) - A DBE is considered a regular dealer of crushed aggregate if the material is purchased in its name, and it engages as its principal business the purchase and sale of crushed aggregate to the general public, or owns and operates the necessary distribution equipment (since aggregate is considered a bulk item) to deliver the crushed aggregate. Under these circumstances, the DBE can be considered a regular dealer and 60% of the cost of the crushed aggregate purchased is credited towards the goal. Anchor: #JOHKQLSI

- Packager, Broker, or Manufacturer’s Representative - (100% Fees or Commissions) - If the DBE firm does not meet all or any of the functions presented in defining a manufacturer or regular dealer in crushed aggregate but arranges or expedites transactions consistent with industry practice in the delivery of such materials, then the services in the amounts of fees or commissions charged in the procurement and/or delivery of such materials can be credited towards the goal.

Trucking Firm

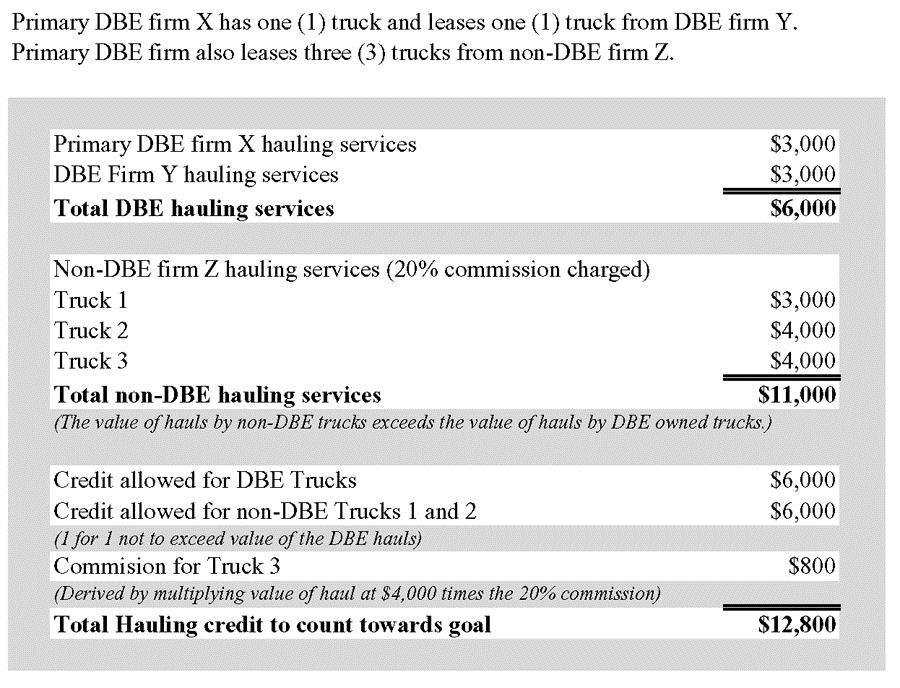

There are several ways to count DBE credit for the services of DBE trucking firms. The DBE must have at least one truck and driver of its own, but it can lease the trucks of others, both DBEs and non-DBEs, including owner operators.

The following are ways to count DBE credit for the services of DBE trucking firms:

- Anchor: #TKRKKOKV

- For work done with its own trucks and drivers, and for work with DBE lessees, the primary DBE trucking firm receives 100% credit for all transportation services provided. Anchor: #THUCNVGG

- If a non-DBE trucking firm hires second tier DBE trucking firms and DBE truck owner-operators, then 100% credit will be counted. Credit will not count for the amount of any fees that are deducted from the DBE trucking firm’s payment, such as, fuel costs, other fees, etc. Anchor: #MWHOMBKB

- If the primary DBE trucking firm leases trucks from non-DBE firms, but uses its own employees as the drivers, then 100% credit will be counted. No credit will be allowed for 1099 employees. The primary DBE trucking firm must own and operate at least one truck used on the project. Anchor: #RWBLXFPO

- For work done with non-DBE lessees, the primary DBE trucking firm gets credit only for the fees or commissions it receives for arranging the transportation services. Anchor: #IQKQYYKL

- A primary DBE trucking firm may lease non-DBE trucks on a 1 for 1 basis for credit of the value of transportation services provided. If the hauling services performed by non-DBE trucks exceed the hauling services provided by the primary DBE trucking firm, the credit is limited to the fees and commissions only.

Figure 6-1. Example of Trucking

Anchor: #i1000642Joint Venture

A joint venture is defined as an association of a DBE firm and one or more other firms to carry out single, for-profit business enterprise, for which the parties combine their property, capital, efforts, skills, and knowledge, and in which the DBE is responsible for a distinct, clearly defined portion of the work of the contract and whose shares in the capital contribution, control, management, risks, and profits of the joint venture are commensurate with its ownership interest.

When a DBE firm performs as a participant in a joint venture, TxDOT will count a portion of the total dollar value of the contract equal to the distinct, clearly defined portion of the work of the contract that the DBE performs with its own forces toward the DBE goal.

TxDOT will assess each joint venture agreement proposed to meet all or a portion of a DBE participation goal by using the following criteria:

- Anchor: #GXUFOBFI

- Does the relationship, or any aspect of such, between the DBE and non-DBE conflict with the ownership and control requirements specified in contract provisions? Anchor: #GOHWGASX

- Is the DBE an independent business concern separate and apart from the non-DBE partner in the proposed agreement? Anchor: #VDUAJDWI

- Is the DBE’s share in the ownership, control, management responsibilities, risks, and profits of the joint venture commensurate with the DBE’s ownership in a joint venture? Anchor: #SFWTKYHP

- Does the agreement clearly define the work to be performed by the DBE? Anchor: #NTEDDSDM

- Is the work to be performed by the DBE in conformance with the contractual and statutory provisions governing the DBE’s performance of a Commercially Useful Function?