Section 2: Utility Property Ownership

Anchor: #i1003635Public Utility Easement (PUE) Reimbursement Considerations

PUEs are rights obtained by an LPA when property is platted or re-platted for development. Right of way is reserved to accommodate utility access to the development. This right of way is intended for use of all utilities, and therefore conveys a compensable interest to any utility placed within the easement. However, the PUE does not convey a replacement right of way interest to any occupants of the PUE. The Texas 14th Court of Appeals ruled that utilities should be reimbursed for costs directly attributable to work performed in a PUE.

All utilities within a PUE have compensable rights if any portion of the easement were to be incorporated into the proposed right of way limits of a transportation project. The incorporated portion gives the utilities within that portion the right to request TxDOT cost participation in any adjustment to those specific facilities.

In this case, the utilities located within the easement would be eligible for costs to relocate or adjust their facilities on a one-time basis, and would not be eligible to retain any future compensable rights.

Anchor: #i1003667Acquisition of Right of Way from a Utility Property Owner

If a utility owns fee title to property required for a proposed right of way project, it is TxDOT’s preferred practice to acquire fee title to that property. If the facilities or operations of a public utility are affected on the required right of way, the facilities will be eligible for State cost participation. This cost participation will be in accordance with the appropriate Standard Utility Agreement.

Anchor: #i1003681Compensation Considerations

A utility easement is a specific right to a legally described parcel of land that has been, or can be, recorded in the Real Property Records of the county.

In some situations, a property interest may not be possessed by a utility, but eligibility for State cost participation may be appropriate to compensate for the required adjustment. Compensation consideration may be appropriate for a railroad license agreement in favor of a utility predating a public right of way, or a joint occupancy agreement between two separate utilities (typically occupying poles) if the primary utility (typically pole owner) holds a property interest.

Occasionally, a utility will occupy, by statutory authority, areas covered by the property rights of another entity. This does not entitle the utility to retain any compensable right or to purchase replacement rights if acquisition of the area becomes necessary for a transportation project. However, the utility is entitled to reimbursement of a compensable cost to adjust its facilities on a one-time basis.

If questions arise regarding the status of rights claimed by a utility, that utility is responsible for documentation of these rights. TxDOT reviews property rights claimed by the utility to determine if a compensation consideration or a property right exists before making an agreement to adjust the utility’s facilities.

For a utility agreement assembly to be a candidate for approval, the utility’s compensation consideration must be clearly documented and supported by verifiable evidence, such as a recorded deed, easement, or lease. In situations where evidence of property interest is inadequate to support compensability, compensation consideration issues must be resolved before District approval of the utility agreement assembly.

The District may request pre-approval of the compensation consideration claim in writing. The request may include submission of completed affidavits, form ROW-U-Affidavit, from a Utility Owner and a Disinterested Party or Property Owner, as appropriate, to support the property interest claim. To utilize the affidavit validation of property interest(s) there must be one (1) affidavit from the utility owner, as well as one (1) affidavit from a disinterested party or a property owner. A ROW Attorney will review the District’s request and reply with comments.

License agreements with a railroad that document a compensation consideration for a utility must have been executed before the highway facility was constructed. Otherwise, no compensation consideration can be acknowledged.

When municipally owned utilities are located in a city street where no previous adjustment has been performed and later becomes part of the State Highway System, a current project requiring adjustment of those municipally owned utilities may be deemed reimbursable by the State.

Anchor: #i1003774Eligibility Ratio

Eligibility for reimbursement of utility adjustment costs must be clearly identified. The District may seek pre-approval of the eligibility ratio from ROW Division and continue processing the utility agreement assembly for approval. Eligibility issues must be resolved before District approval of the utility agreement assembly.

Scenarios of eligibility, including eligibility ratios, are available in PDF format. The eligibility ratios found on these scenarios are based primarily upon proportional property rights as measured along the centerline of the existing utility facility. When the conflict lies solely within the joint use/acquisition of the utility’s property, the eligibility ratio is 100%. Scenarios are available in PDF format. Each example scenario shows the appropriate eligibility ratio.

For example, if it is assumed that the total width of the proposed highway right of way is 300-feet, and 100-feet of the utility’s existing facility is presently located on highway right of way by statutory right, and 200 feet is presently occupying utility right of way (or utility easement), then TxDOT will participate in 66.67% (200’/300’) of the total cost of the required adjustment after deducting any credits due for betterment and salvage.

The key determining factors for eligibility ratio are:

- Anchor: #DMJOQDVB

- line length for underground pipelines, cables, or Anchor: #GLYIMESP

- main line pole location for power and overhead communication facilities. Guy poles, push braces, and down guys must be excluded from the ratio as these items are considered as supporting structures.

In developing the ratio, line length or number of poles is restricted to existing facilities located within the existing and proposed highway right of way. Existing facilities located outside the existing and proposed right of way limits will not be used in developing the ratio. However, the percentage established from the ratio will be applied to all applicable costs necessary for the adjustment. If multiple underground cables are located within the general location and owned by the same utility, then use the overall length of the facility to calculate the eligibility ratio. When calculating eligibility ratio, counting the length of the pipe and the cable carried within the pipe is not acceptable.

All applicable adjustment costs will be ineligible for TxDOT cost participation when line poles are on highway right of way by statutory right, and guy poles, push braces and/or down guys are on utility-owned right of way. However, TxDOT will participate in right of way costs incurred in conjunction with adjustment of the guy poles, push braces, and/or down guys. The basis for developing the ratio for underground pipelines, cables, overhead power and communication facilities is as follows:

Although line lengths for pole line adjustments are not generally used as a basis for determining an eligibility ratio, special conditions (e.g., transmission towers, railroad intersections) may warrant consideration for such handling. When these conditions exist, all factual data must be submitted to the District for determination regarding the appropriate method of handling.

When there are facilities to be removed and not replaced, the establishment of an eligibility ratio must not include these facilities. Utility adjustment charges must be prorated only on those facilities being functionally replaced. For further information see Section 6.

The State’s participation must be limited to replacement-in-kind of the utility’s property interest, including length, width, and type. The established eligibility ratio must be applied to all costs associated with the accommodation.

Anchor: #i1003850Calculating the Eligibility Ratio at Railroads

The eligibility ratio in the case of a license agreement between a railroad and a utility is determined by the following formula:

Width of the Existing Highway = 100’

Width of the Proposed Highway = 150’

Therefore, as an example, if the existing highway is 100 feet wide, and the proposed highway is 150 feet wide, then the eligibility ratio would be 50’ divided by 150’ = 33.33%.

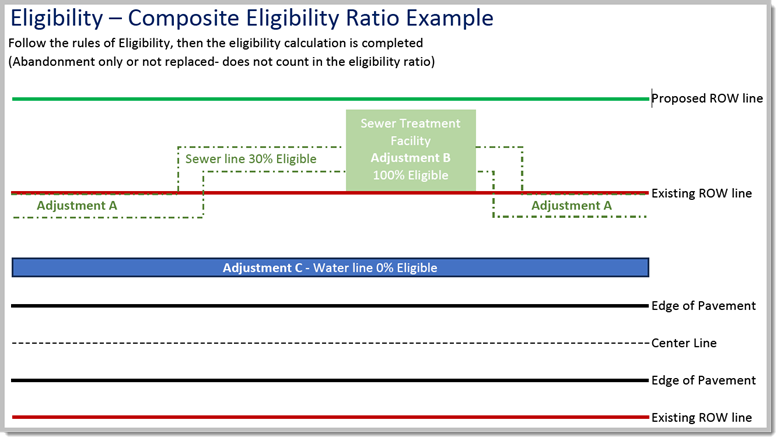

Anchor: #i1003865Composite Eligibility Ratios (CER)

On any given project, there may be multiple utility adjustments at different locations within the highway right of way project limits. When these different locations contain different line sizes and/or eligibility ratios, it will be necessary to calculate a CER. A CER is calculated to mitigate administrative and accounting difficulties encountered with simultaneous work sites having different individual eligibility ratios. The total cost of the adjustment should include all cost associated with the adjustment including engineering, construction, administration, inspection, etc. When calculating eligibility ratio, counting the length of the pipe and the cable carried within the pipe is not acceptable.

The formula for determining a CER is:

CER= [(X+Y+Z) / (A+B+C)] * 100%

Where:

- Anchor: #NUOMMSYB

- A= Total Cost of Adjustment of Utility “A” Anchor: #BQSTBHBB

- B= Total Cost of Adjustment of Utility “B” Anchor: #LALYKBDA

- C= Total Cost of Adjustment of Utility “C” Anchor: #JDHJMMVS

- X= “A” times the Eligibility Ratio for Utility “A” Anchor: #VDLYCWNL

- Y= “B” times the Eligibility Ratio for Utility “B” Anchor: #PUMLIVUI

- Z= “C” times the Eligibility Ratio for Utility “C.”

For example using the scenario shown in Table 8-1 and Figure 8-1:

|

Facility to be adjusted |

Total Cost of Adjustment |

Individual Eligibility Ratio |

X, Y & Z Factors |

|---|---|---|---|

|

City Sewer Line – Adjustment A |

$300,000 |

30% |

X = $90,000 |

|

City Sanitary Sewer Treatment - Adjustment B |

$100,000 |

100% |

Y = $100,000 |

|

City Water Line – Adjustment C |

$20,000 |

0% |

Z = $0 |

Figure 8-1. Example Scenario for CER Calculation

CER= [(X+Y+Z) / (A+B+C)] * 100%

= [(90,000 +100,000 + 0) / (300,000 + 100,000 + 20,000)] * 100%

= [190,000/420,000] * 100%

= 0.452381*100%

= 45.24%

Therefore, the CER for this example would be 45.24%.

The burden of proof regarding compensable interest lies with the utility company!

When reviewing and approving the eligibility ratios, the District must consider appropriate affidavits and attachments.